Toncoin (TON) has shown better performance than Bitcoin (BTC) in recent days. TON has increased 21.36

TON’s social volume increased by more than 20

TON’s social volume has been decreasing for a while but has rebounded since May 1. The price has also recovered from a drop from

During this time, sentiment was positive in the community but negative in the press, suggesting that there are rising concerns in the Toncoin market. The average age of dollar investments has gradually increased over the past month, suggesting accumulation is taking place.

The number of inactive tokens has remained minimal throughout the past month. This data recorded a spike on April 10 and there has been no further growth since then. This spike coincides with the local peak of TON.

Therefore, traders and investors can observe data about inactive tokens. A rapid and large spike may indicate that a local peak may have formed.

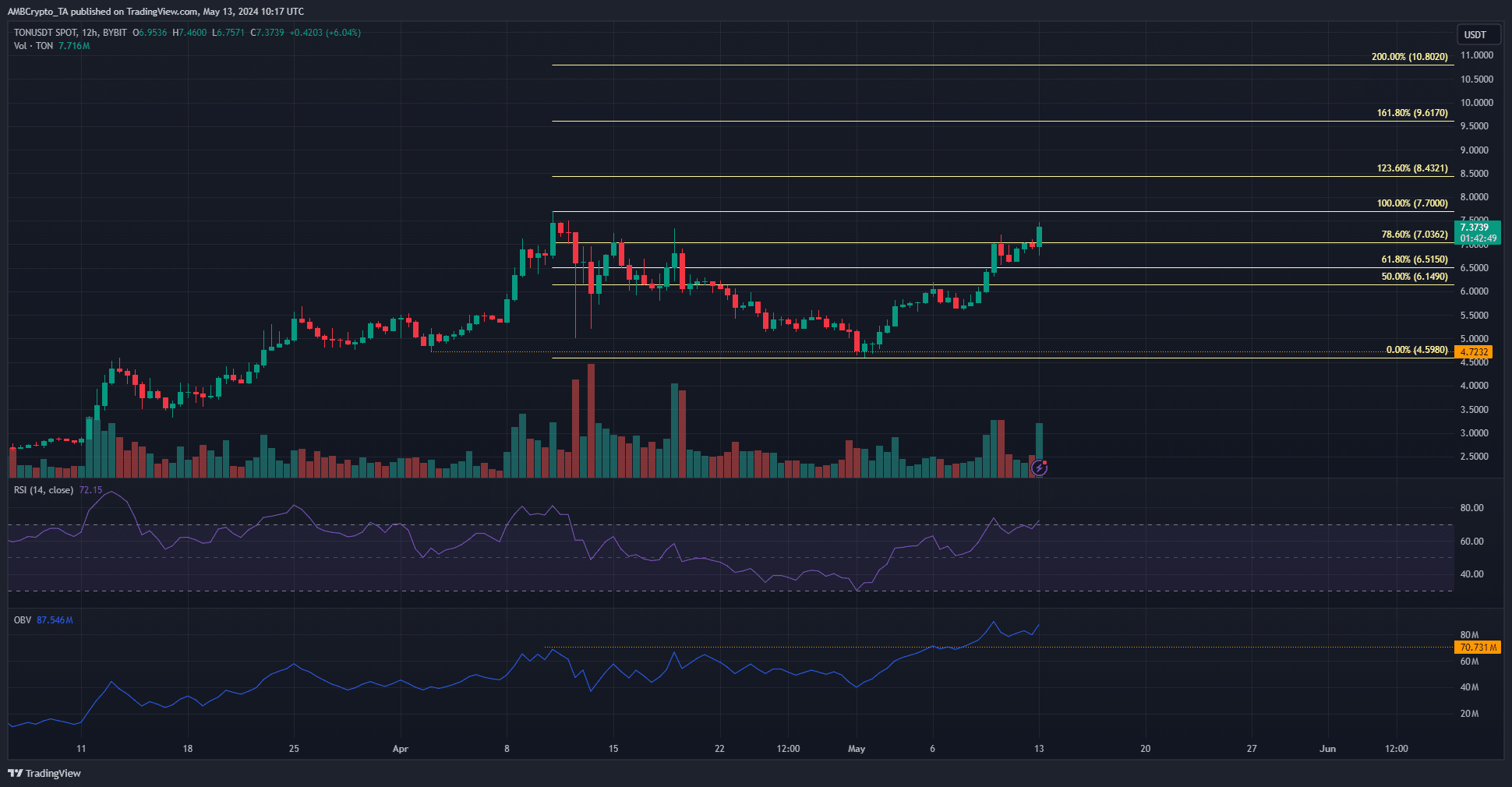

Source: TON/USDT on TradingView

Relative strength compared to Bitcoin is an important factor, and TON has demonstrated much of that strength. TON’s performance in May among the top 10 assets by market capitalization will continue to encourage buyers. While Bitcoin falls below $60k and faces another rejection, TON could surge higher.

Fibonacci levels show that the potential for further upside is positive. Breaking above the 78.6