What is eTims in Kenya?

eTims stands for Electronic Tax Invoice Management System. In simpler terms, it’s a software solution designed to streamline the process of issuing electronic tax invoices for businesses in Kenya.

Think of it as a digital upgrade from the old system called Tims. With eTims, you can generate invoices electronically, ensuring accuracy, security, and improved record-keeping.

Furthermore, eTims integrates seamlessly with the KRA systems, allowing for efficient tax filing and reducing the risk of errors.

The law requires that for any person to claim their business expense, the expense must be supported by an electronic tax invoice.

For this reason, all persons engaged in business in Kenya are required to onboard eTIMS and issue electronic tax invoices and transmit the invoices to KRA through the system.

These include persons conducting business in various sectors, including the informal sector and persons in business whether or not registered for VAT.

Companies, partnerships, sole proprietorships, associations, trusts and persons with income tax obligations including monthly rental income, turnover over tax and annual income tax for corporations, partnerships and individuals (both resident and non-residents) are required to onboard eTIMS.

VAT-registered taxpayers who adopted the TIMS ETR may continue to use the devices for purposes of invoicing and transmitting tax invoices to KRA.

However, anyone facing technical challenges using TIMS ETR devices is encouraged to migrate to eTIMS to allow business continuity.

The eTIMS software is offered free of charge by KRA although businesses that are integrating their invoicing system directly to eTIMS may incur costs if they opt to partner with one of the approved 3rd party integrators, as opposed to self-integration.

KRA has appointed 3rd party integrators to facilitate the integration process for taxpayers and the list of approved 3rd party integrators is available on the KRA website.

Their work is to integrate the billing systems of businesses with eTIMS.

Information on how a person can be certified as a 3rd party integrator or as a self-integrator is available on the KRA website under the eTIMS menu.

eTIMS can be accessed on various computing devices, including computers, laptops, tablets, smartphones and Personal Digital Assistants (PDAs).

Does one require internet connectivity to invoice through eTIMS?

According to KRA, online solutions like online portal and Online Sales Control Unit (OSCU) require a stable internet connection to generate invoices.

However, in case of internet downtime, other solutions like eTIMS Client and Virtual Sales Control Unit (VSCU) allow you to continue generating tax invoices but once the internet connection is restored, the generated invoices will be transmitted to KRA.

eTIMS comes with several benefits including reducing compliance costs as the solutions are provided free of charge.

According to the Kenya Revenue Authority, eTIMS also facilitates simplified return filing for taxpayers and allows taxpayers to maintain records of invoices issued on the taxpayer portal.

The stock management module also assists taxpayers to maintain their own inventory and offers flexibility in the solutions available and is accessible on various computing devices.

The stock management modules are configured during the installation of the software for persons supplying goods.

The eTIMS software supports stock management for both sales (outgoing stock) and purchases (incoming stock).

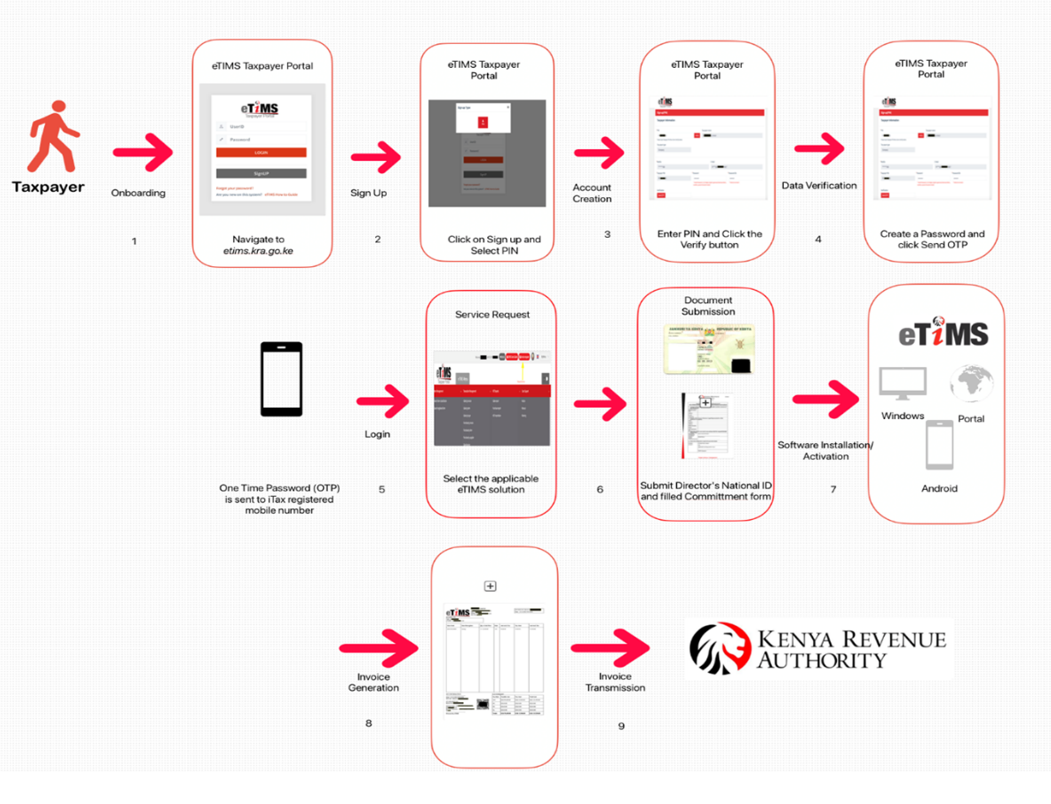

How to onboard eTIMS

Go to the eTIMS Taxpayer Portal etims.kra.go.ke

Click on the Sign-Up button and input your PIN.

One Time Password (OTP) will be sent to your iTax-registered mobile number.

Input the OTP sent to your registered mobile number on the signup page and you will be prompted to create a password for your profile.

Log in to the eTIMS taxpayer portal using your User ID (KRA PIN) and the password created during sign-up.

Click on the Service Request button and select your preferred eTIMS software solution listed under the “eTIMS Type” menu.

You will then be required to upload a copy of your ID if you are a sole proprietor or a copy of the ID of at least one of the directors for companies or one of the partners for partnerships.

Once you submit your application, an authorised KRA officer will verify the application and approve it as appropriate.

To verify whether an electronic tax invoice is valid, scan the QR code and then input the invoice number on the ” Invoice number checker ” menu on the iTax portal.

Types of eTims Solutions Available in Kenya

One of the biggest advantages of eTims is its flexibility. KRA recognizes that businesses come in all shapes and sizes, with varying needs and technical capabilities.

To cater to this diversity, eTims offers a range of solutions:

-

eTIMS Lite (Web): This user-friendly web application allows you to generate e-invoices directly through a web browser. No software download is required, making it a convenient option for businesses on the go.

-

eTIMS Lite (USSD): This innovative solution leverages USSD technology, allowing you to generate basic e-invoices using your mobile phone. This is a game-changer for micro-businesses and those operating in remote locations with limited internet access.

- eTIMS Taxpayer Portal: This is the central hub of your eTims experience. It’s a web-based portal that allows you to manage your eTims account, access various functionalities, and monitor your e-invoice activities.

- eTIMS Client: This downloadable software is ideal for businesses that prefer a desktop application for invoice generation. It offers all the core functionalities of eTims and can be installed on your computer.

-

Virtual Sales Control Unit (VSCU): This advanced solution is designed for businesses with high transaction volumes. It allows for integration with your existing invoicing or Enterprise Resource Planning (ERP) system, enabling seamless data transfer and automated invoice generation.

-

Online Sales Control Unit (OSCU): This cloud-based version of the VSCU offers similar functionalities but eliminates the need for software installation. It’s a perfect option for businesses that prefer a web-based solution for managing their e-invoices.

By offering a variety of solutions, eTims ensures that every business in Kenya, regardless of size or technical expertise, can benefit from this efficient and user-friendly system.

Who should use eTIMS?

All persons engaged in business are required to on-board eTIMS and issue electronic tax invoices.

Why is it not just for VAT registered taxpayers?

The law requires that for any person to claim their business expense, the expense must be supported by an electronic tax invoice. Therefore, all persons engaged in business are required to issue electronic tax invoices, whether registered for VAT or not (non-VAT taxpayers).

Why eTIMS?

- It aids in reducing compliance costs as the solutions are provided free of charge;

- eTIMS offers flexibility in the solutions available and is accessible on various computing devices;

- The stock management module assists taxpayers maintain their own inventory;

- eTIMS allows taxpayers to a maintain record of invoices issued on the taxpayer portal;

- eTIMS facilitates simplified return filing for taxpayers.

What are the solutions available on eTIMS?

The solutions available include:

- Online Portal- Tailored for taxpayers in the service sector exclusively, where no goods are supplied.

- eTIMS Client – A downloadable software designed for taxpayers dealing in goods or both goods and services. The software supports multiple branches and pay points/cashier tills.

- Virtual Sales Control Unit (VSCU) – This solution enables seamless system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS, catering to taxpayers with extensive transactions or bulk invoicing.

- Online Sales Control Unit (OSCU) – This solution also facilitates system-to-system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is ideal for taxpayers using an online invoicing system.

How to Register for eTims in Kenya

Now that you understand the benefits of eTims, let’s walk you through the registration process. Here’s a step-by-step guide to get you started:

1. Visit the eTims Taxpayer Portal:

- Open your web browser and navigate to the official eTims Taxpayer Portal: https://etims.kra.go.ke/. This is the central online platform for all your eTims activities.

2. Sign Up for an Account:

- Click on the “Sign Up” button located on the homepage.

- Enter your valid KRA PIN (Kenya Revenue Authority Personal Identification Number) in the designated field.

- You’ll receive a One-Time Password (OTP) on your mobile number registered with iTax. This is a security measure to verify your identity.

- Enter the received OTP in the designated field on the sign-up page.

- Create a strong password for your eTims account. Remember to choose a complex password that combines uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like your birthday or name.

3. Log In to Your Account:

- Once you’ve successfully created your account, return to the eTims Taxpayer Portal homepage.

- Enter your KRA PIN and the password you created during registration in the designated login fields.

- Click the “Login” button to access your eTims dashboard.

4. Select Your Preferred eTims Solution:

- Upon logging in, you’ll be presented with a user-friendly dashboard. Locate the section for “Service Request” and click on it.

- Here, you’ll see a list of available eTims solutions. As discussed earlier, these solutions cater to different business needs. Carefully review the descriptions of each solution to determine the most suitable option for your business.

5. Upload Required Documents:

- Once you’ve chosen your preferred eTims solution, you’ll be prompted to upload specific documents for verification purposes. The required documents will vary depending on your business structure:

- Sole Proprietorship: You’ll need to upload a clear copy of your valid Kenyan national identification card.

- Partnership: A copy of the partnership deed will be required.

- Company: Upload a copy of the Certificate of Incorporation or any other relevant registration document.

6. Submit Your Application:

- After uploading the necessary documents, carefully review your application to ensure all information is accurate and complete.

- Once satisfied, click the “Submit” button to send your eTims registration application to the KRA.

7. Application Approval:

- The KRA will review your application and supporting documents. This process typically takes a few business days. You’ll receive a notification via email or SMS once your application is approved.

Congratulations! You’re now officially registered for eTims in Kenya. The next section will guide you through generating invoices using your chosen eTims solution.

HOW TO ACQUIRE eTims SYSTEM:

- Copy of ID of the Owner/ Director of the company or Legal Representative;

- Download and fill the Confirmation form downloaded found here to be signed by the Owner/ Director of the company or Legal Representative

AVAILABLE eTims SOLUTIONS AND ELIGIBILITY REQUIREMENTS

-

-

eTIMS CLIENT SOFTWARE (For Windows, Android Tablet and PDA):

-

This solution is specifically designed for Large and Medium Taxpayers, both VAT and non- VAT registered taxpayers, as well as other taxpayers who may apply for it.

Eligibility criteria for eTIMS Client Software

- Taxpayer must be selling goods.

- Taxpayer must have a desktop/laptop running Windows OS; not compatible for MAC computers – Windows 10.0.17 or a later version, 2GB minimum RAM, 20 GB minimum storage.

- Taxpayer has no invoicing system.

Step by Step Guide.

- eTIMS Paypoint User Guide (Windows)

- eTIMS Multi-Paypoint User Guide (Windows)

- eTIMS Paypoint User Guide (Android Tablet)

eTIMS MOBILE APPLICATION:

The solution is suitable for small, micro or newly registered taxpayer whose annual turnover does not exceed five million Kenya Shillings (KES 5,000,000.00) per annum.

Eligibility criteria for eTIMS Mobile

- Suitable for small and micro taxpayers.

- Taxpayer must be in service sector; no provision for stock management.

- Taxpayer must possess a smart phone with android version 8.0 and above with internal storage capacity from 8 GB and above.

Step by Step Guide.

ONLINE eTIMS:

Eligible taxpayers for this solution are those operating in service sector who do not issue more than 10 invoices per month. E.g.: rental property owners, transport service providers, consultants, lawyers, etc

Step by Step Guide.

- eTIMS Online portal User guide

eTIMS SYSTEM TO SYSTEM INTEGRATION:

This solution is designed for taxpayers with an automated billing/ invoicing system who need to integrate their billing/ invoicing system with Kenya Revenue Authority. The system-to-system integration is facilitated through an Online Sales Control Unit (OSCU) or Virtual Sales Control Unit (VSCU).

- Online Sales Control Unit (OSCU) suitable for entities whose invoicing system operates online.

- Virtual Sales Control Unit (VSCU) suitable for entities who undertake bulk invoicing and whose invoicing system does not always operate online.

Taxpayers have an option to undertake self-integration or use a certified third party vendor to facilitate the integration. Persons intending to undertake self-integration or act as third party vendors are required to undergo a certification process prior to commencement of integration.

How to certify an automated billing/ Invoicing System to use OSCU/ VSCU

- Visit KRA Website and go through OSCU or VSCU API technical specifications on how to integrate your Invoicing system.

- Develop and test the OSCU/VSCU integration using the eTIMS sandbox environment. Download step by step guide.

- Apply for certification by submitting eTIMS Bio Data Form and required documentation to KRA eTIMS Operations office.a) Required documentation for of Third Party Vendor integrators certification

- Business Registration Documents – (Certificate of Incorporation/ Business Registration Certificate & CR12)

- Business Permit

- National ID for directors/ partners/ sole proprietor

- Company/ Business Tax Compliance Certificates

- Proof of at least three qualified technical staff handling system development and system administration.

- Notarized declaration by the Third Party Vendor that they are not insolvent, in receivership, bankrupt, or being wound up.

- Technology Architecture documentation of how integration between Trader Invoicing System (TIS) and eTIMS will take place.

- Trader Invoicing System (TIS) integration Software (on optical disk storage) – The vendor will submit to KRA a read only optical disk containing:

- All files that make up the TIS integration Software.

- All the PDF documents needed during the certification process. Note: this Optical Disk (CD or DVD) is to be submitted prior to certification of the TIS integration

b) Required documentation for Taxpayer self-integration certification

-

- Company/ Business Tax Compliance Certificate

- Proof of at least three qualified technical staff handling system development and system administration.

- Technology Architecture documentation of how integration between Trader Invoicing System (TIS) and eTIMS will take place.

- Trader Invoicing System (TIS) integration Software (on optical disk storage) – The vendor will submit to KRA a read only optical disk containing:

- All files that make up the TIS integration Software.

- All the PDF documents needed during the certification process. Note: this Optical Disk (CD or DVD) is to be submitted prior to certification of the TIS integration

- Technical and Administrative review by KRA.

- After successfully integrating with KRA and undergoing the certification process, KRA will issue an interim approval certificate for the VSCU/ OSCU integration.

- Start using your certified integrated invoicing system to issue receipts

- Upon expiry of the interim approval certificate, a review will be undertaken and a final certification issued in case of approval.

If you need any assistance, please contact KRA:

- Email: callcentre@kra.go.ke

- Call us on: +254 20 4 999 999 or +254 711 099 999;

How to Onboard on eTIMS

Download eTIMS Commitment Form

Installation by Taxpayer’s Representatives

A taxpayer can appoint a suitable representative to sign up and install the eTIMS on their behalf. The following is required:

- An introductory letter, signed by at least one of the directors or partner or business owner clearly indicating who has been appointed as the tax representative and their role in the business. Include your contact information, in case a KRA official will need to get in touch with you.

- The director(s) or partner(s) or owner of the business should fill in and sign the eTIMS Acknowledgement & Commitment Form

- Copy of the director’s/partner’s/owner’s National ID

- Copy of CR12 form for companies or Partnership Deed for Partnerships.

Where do I install eTIMS?

eTIMS can be installed on either of the following devices:

- Windows based computers & laptops.

- Android smart phones, tablets & Personal Digital Assistant (PDA) devices.

How to Onboard on eTIMS

Steps to follow:

- Sign up on the eTIMS Taxpayer Portal via etims.kra.go.ke

- Click on the Sign Up button and input your PIN.

- A One Time Password (OTP) will be sent to your iTax registered mobile number.

- Input the OTP sent to your iTax registered mobile number on the sign up page and you will be prompted to create a password for your profile to complete the sign up process.

- Log in to the eTIMS taxpayer portal using your User ID (KRA PIN) and the password created during sign up.

- Click on the Service Request button to select your preferred eTIMS software solution listed under the “eTIMS Type” menu

- Upload the following documents:

a. A copy of the National ID of:

-At least one of the Directors for companies

-At least one of the partners for partnerships

-The business owner for sole proprietorships

b. Duly filled in Commitment form – the form is accessible on the KRA website (click on Publications then click on eTIMS and search for the

eTIMS Acknowledgement & Commitment Form)

8. Submit your application to complete the onboarding process.

What happens after eTIMS on boarding & registration?

- An authorized KRA officer will verify the application and approve as appropriate.

- Install and configure the eTIMS software on the preferred device:

-For self-installation, one can access the “User guides” on the KRA website and “How to Videos” on the KRA You Tube channel

-Taxpayers can also visit the nearest KRA office for assistance.

Installation by Taxpayer’s Representatives

A taxpayer can appoint a suitable representative to sign up and install the eTIMS on their behalf. The following is required:

- An introductory letter, signed by at least one of the directors or partner or business owner clearly indicating who has been appointed as the tax representative and their role in the business. Include your contact information, in case a KRA official will need to get in touch with you.

- The director(s) or partner(s) or owner of the business should fill in and sign the eTIMS Acknowledgement & Commitment Form

- Copy of the director’s/partner’s/owner’s National ID

- Copy of CR12 form for companies or Partnership Deed for Partnerships.

The above documents should be uploaded by the representative on the eTIMS portal.

eTIMS System to System Integration

This solution is tailored for businesses that have an invoicing system and would like to integrate with eTIMS. This integration is possible via the Virtual Sales Control Unit (VSCU) or Online Sales Control Unit (OSCU).

- Virtual Sales Control Unit (VSCU) – this solution allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers with numerous transactions/bulk invoicing.

- Online Sales Control Unit (OSCU) – this solution also allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers using an online invoicing system.

Taxpayers can choose to initiate the self-integration process or enlist the services of KRA-verified third-party integrators, whose information is available on the KRA website.

The following links provide further information on self-integration, third party integrators and technical specifications:

- Visit the eTIMS portal.

- A step by step guide on how to sign upand technical Specification for the Trader Invoicing System (TIS) is also available for download.

Ready to Use and Install eTIMS?

Download and install eTIMS using any of the links below based on the device applicable to you.

- eTIMS Multi-Paypoint (Windows) Tooltip text

- eTIMS Paypoint (Windows).Tooltip text

- eTIMS Paypoint (Android).Tooltip text

- eTIMS Lite (VAT).Tooltip text

- eTIMS Lite (Non VAT). Tooltip text

- You can also access the Online portal.

Step by Step Guides for eTIMS

- eTIMS Online portal User guide

- eTIMS Paypoint User Guide (Android)

- eTIMS Lite (VAT) User Guide

- eTIMS Multi-Paypoint User Guide (Windows)

- eTIMS PayPoint User Guide (Windows)

eTIMS System to System Integration

This solution is tailored for businesses that have an invoicing system and would like to integrate with eTIMS. System-to-system integration between KRA and the taxpayer’s invoicing systems has been provisioned via an Application Programming Interface (API). This can be achieved in two ways; An Online Sales Control Unit (OSCU) for entities whose invoicing is always online or a Virtual Sales Control Unit (VSCU) for entities undertaking bulk invoicing and whose invoicing is not always online. The process will entail the development, testing, vetting, and certification of either the interested taxpayer who has the capacity to self-integrate or for 3rd party software developers (integrators) to facilitate the taxpayer integration process.

- Virtual Sales Control Unit (VSCU) – this solution allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers with numerous transactions/bulk invoicing.

- Online Sales Control Unit (OSCU) – this solution also allows for a system to system integration between the taxpayer’s invoicing/ERP system and eTIMS. It is suitable for taxpayers using an online invoicing system.

Taxpayers can choose to initiate the self-integration process or enlist the services of KRA-verified third-party integrators, whose information is available on the KRA website.

The links below provide information on the integration process and specification documentation to commence the testing process:

- OSCU Specification document

- VSCU Specification document

- Step by step guide on how to register in sandbox

- Technical Specification for the Trader Invoicing System

Under the taxpayer portal(etims.kra.go.ke), you will find more information on the system to system including the bio data and required documents as a third party vendor.

What happens after eTIMS onboarding & registration?

- An authorised KRA officer will verify the application and approve as appropriate.

- Install and configure the eTIMS software on the preferred device:

-For self-installation, you can use the step by step user guides.

-Taxpayers can also visit the nearest KRA office for assistance.

Step by Step on How to Onboard

-

Step 1Go to the eTIMS Taxpayer portal (etims.kra.go.ke)

Step 1Go to the eTIMS Taxpayer portal (etims.kra.go.ke) -

Step 2Click on the Sign-Up button and input your PIN

Step 2Click on the Sign-Up button and input your PIN -

Step 3One Time Password (OTP) will be sent to your iTax registered mobile number

Step 3One Time Password (OTP) will be sent to your iTax registered mobile number -

Step 4Input the OTP sent to your registered mobile number on the sign up page and you will be prompted to create a password for your profile.

Step 4Input the OTP sent to your registered mobile number on the sign up page and you will be prompted to create a password for your profile. -

Step 5Log in to the eTIMS taxpayer portal using your User ID (KRA PIN) and the password created during sign up.

Step 5Log in to the eTIMS taxpayer portal using your User ID (KRA PIN) and the password created during sign up. -

Step 6Click on the Service Request button and select your preferred eTIMS software solution listed under the “eTIMS Type” menu.

Step 6Click on the Service Request button and select your preferred eTIMS software solution listed under the “eTIMS Type” menu. -

Step 7Upload the following documents: i.A copy of the National ID of: a.At least one of the directors for Companies b.At least one of the partners for Partnerships c.The business owner for sole proprietorships ii.Duly filled eTIMS Commitment Form The form is accessible on the KRA website (click on Publications then click on eTIMS and search for the ‘eTIMS Acknowledgement & Commitment Form’).

Step 7Upload the following documents: i.A copy of the National ID of: a.At least one of the directors for Companies b.At least one of the partners for Partnerships c.The business owner for sole proprietorships ii.Duly filled eTIMS Commitment Form The form is accessible on the KRA website (click on Publications then click on eTIMS and search for the ‘eTIMS Acknowledgement & Commitment Form’). -

Step 8Submit your application. An authorized KRA officer will verify the application and approve as appropriate

Step 8Submit your application. An authorized KRA officer will verify the application and approve as appropriate -

Step 9Install and configure the eTIMS software on the preferred device: i.For self-installation, one can access the ‘User Guides’ as found in the KRA website and ‘How to Videos’ on the KRA YouTube channel ii.Taxpayers can also visit the nearest KRA office for assistance.

Step 9Install and configure the eTIMS software on the preferred device: i.For self-installation, one can access the ‘User Guides’ as found in the KRA website and ‘How to Videos’ on the KRA YouTube channel ii.Taxpayers can also visit the nearest KRA office for assistance.

How to Onboard on eTIMS Lite via eCitizen

-

Step 1On your computer/laptop/tablet/phone, open the browser,KRA eCitizen portal.

Step 1On your computer/laptop/tablet/phone, open the browser,KRA eCitizen portal.

-

Step 2If you have an eCitizen account click on Sign In and if not click on sign up.

Step 2If you have an eCitizen account click on Sign In and if not click on sign up.

-

Step 3For OTP verification select whether to receive the OTP via email or phone number and thereafter an OTP will be sent

Step 3For OTP verification select whether to receive the OTP via email or phone number and thereafter an OTP will be sent

-

Step 4Input the OTP in the relevant field and click Next.

Step 4Input the OTP in the relevant field and click Next.

-

Step 5You will be redirected to the KRA eCitizen user interface. To initialize eTIMS, click the Invoicing (eTIMS) button

Step 5You will be redirected to the KRA eCitizen user interface. To initialize eTIMS, click the Invoicing (eTIMS) button

-

Step 6

Step 6Check the two boxes to confirm that they agree with the terms and conditions and privacy policy. Once the Activate E-Invoicing button becomes active, click on it. You have now onboarded on eTIMS Lite

List of Approved eTIMS Third Party System To System Software Integrators as at 1st August, 2024 https://www.kra.go.ke/images/publications/List-of-Approved-eTIMS-3rd-party-integrators-as-at-1st-Aug-2024-2.pdf

eTIMS Multi-Paypoint User Guide (Windows) https://www.kra.go.ke/images/publications/eTIMS-Multipaypoint-Windows-User-guide-2024.pdf

eTIMS Online Portal User Guide https://www.kra.go.ke/images/publications/eTIMS-Onlineportal-User-guide-2024.pdf

Requirements/Specifications for Virtual Sales Control Unit (VSCU) integration.(API) https://www.kra.go.ke/images/publications/VSCU_Specification_Document_v2.0.pdf

Step by Step Guide on How to Sign Up for Online Sales Control Unit (OSCU) and Virtual Sales Control Unit (VSCU) https://www.kra.go.ke/images/publications/OSCU_VSCU_Step-by-Step_Guide-on-how-to-sign-up.pdf

Procedure For eTIMS Application https://www.kra.go.ke/images/publications/eTIMS-Onboarding-procedure-User-guide-2024.pdf

How to Register on eTIMS Lite – USSD https://www.kra.go.ke/images/publications/eTIMS-Lite-Useguide—USSD.pdf

Guidelines to Taxpayers on eTIMS Onboarding https://www.kra.go.ke/images/publications/eTIMS-Taxpayer-Guidelines_2024.pdf

How To Sign up On eTiMS Via eCitizen

Information on how eTIMS works – 16/07/2024

eTIMS Training

ANY CHALLENGE WITH ETIMS REGISTRATION OR ONBOARDING WE HELP WHATSAPP wa.me//254798761870